How to Prepare Your Dealership for a Financial Audit

Last updated: 3rd February, 2024

As a car dealership, it is crucial to stay organized and prepared for financial audits. DealerPal specializes in providing digital solutions that simplify your accounting processes and minimize errors. In this blog post, we will provide you with valuable tips on how to prepare your dealership for a financial audit.

Understand Your Financial Audit Requirements

To ensure a smooth auditing process, it's essential to understand the requirements set by your regulatory bodies. DealerPal can help you identify any gaps or areas of improvement in your current accounting practices. Our expert team will guide you through the necessary steps to prepare your records and ensure compliance with industry standards.

Gather Required Documents and Information

Accurate record-keeping is vital when it comes to financial audits. DealerPal suggests keeping a comprehensive record of all transactions, including sales, purchases, and expenses. Ensure that all supporting documents, such as invoices, receipts, and bank statements, are easily accessible for auditors.

Train Your Staff on Audit Procedures

Educating your staff on audit procedures will help reduce errors and minimize the impact of an audit on your business operations. DealerPal offers comprehensive training programs designed specifically for dealerships. Our expert trainers will guide your team on how to navigate audits with ease, reducing anxiety and minimizing disruption to your daily activities.

In conclusion, preparation is key when it comes to financial audits. By understanding the requirements set by regulatory bodies, gathering required documents and information, and training your staff on audit procedures, you'll be well-prepared for a smooth and stress-free auditing process. Contact DealerPal today to learn more about our services and take control of your accounting processes.

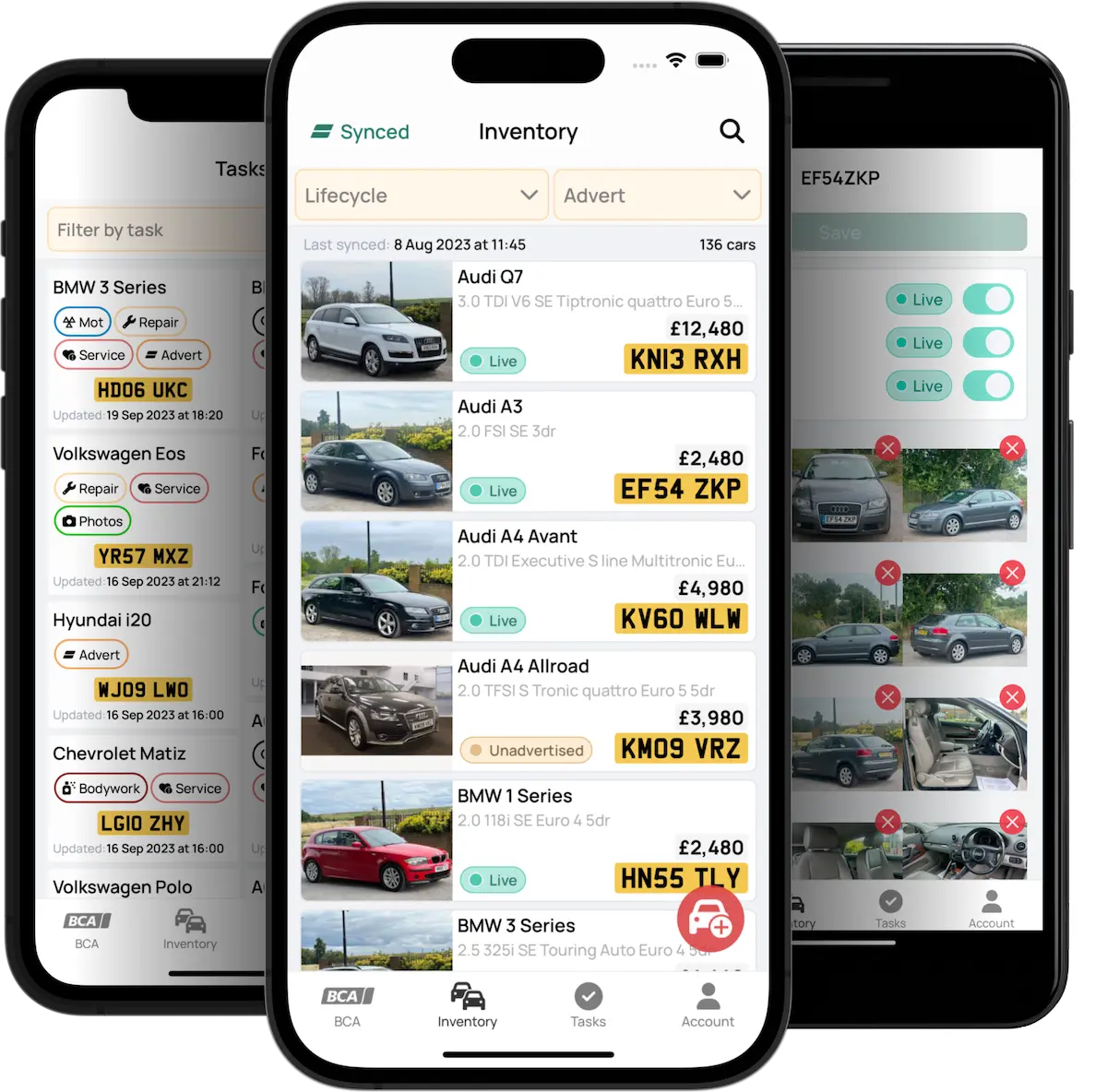

Save 10+ hours per week with our DMS

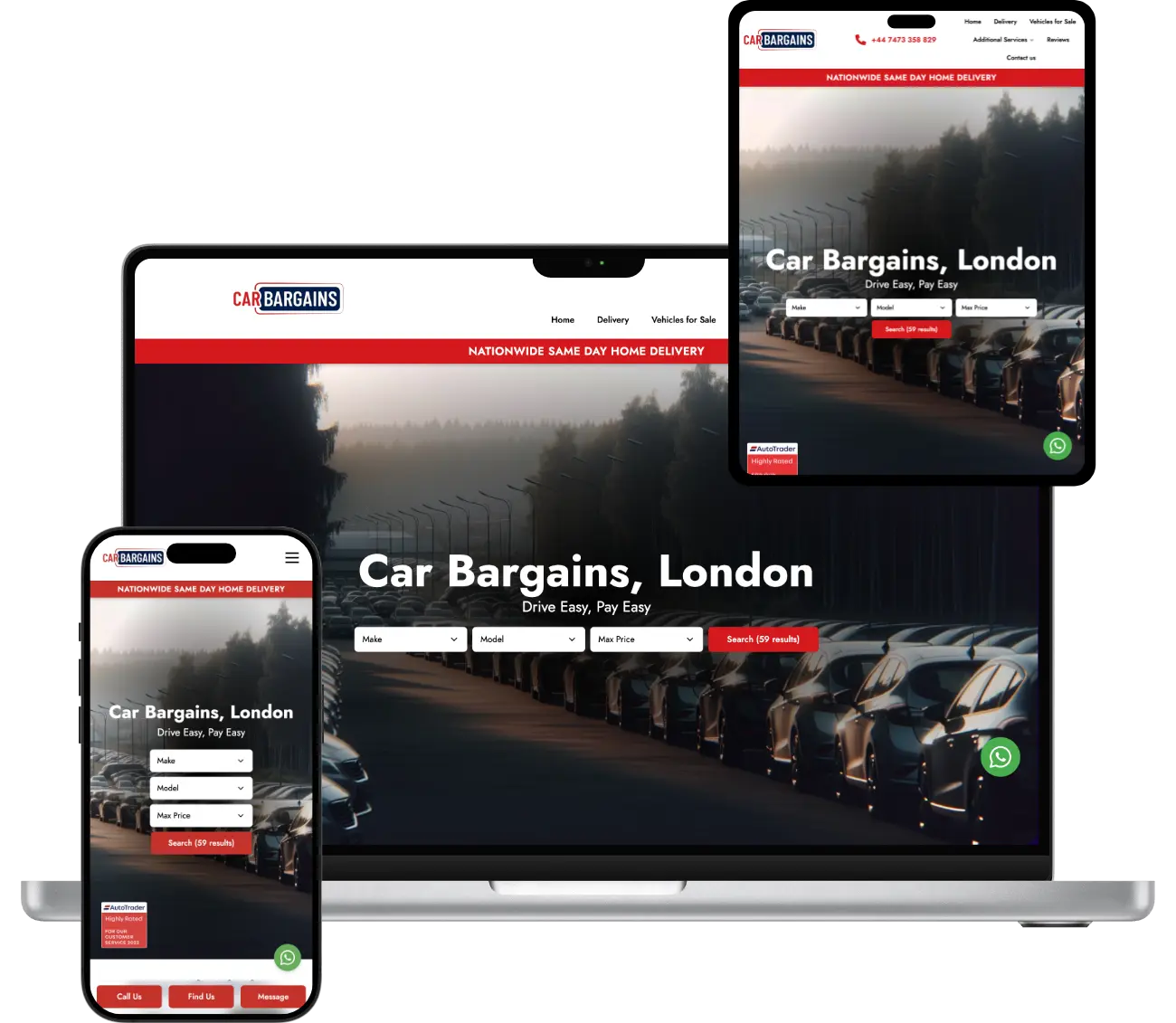

Sell more with our SEO-mastered retail websites

Branding that'll set you apart from the competition