Guide to Choosing the Right Insurance for Your Dealership

Last updated: 22nd February, 2024

Choosing the right insurance for your dealership is a crucial step in protecting your business and its assets. At DealerPal, we understand that navigating the world of insurance can be overwhelming, which is why we're here to guide you through the process.

Understanding Your Risks

As a car dealership, you face unique risks that require specialized coverage. Natural disasters, employee theft, equipment breakdowns, and customer accidents are just a few examples of the potential hazards your business may encounter. By understanding these risks, you can create an insurance plan that adequately addresses them.

Insurance Options for Dealerships

DealerPal recommends considering the following types of insurance to protect your dealership:

- Commercial auto insurance: Covers company-owned vehicles, as well as personal vehicles used for business purposes.

- Business property insurance: Provides coverage for buildings, equipment, and inventory against damage or loss.

- Workers' compensation insurance: Protects employees in case of work-related injuries or illnesses.

- General liability insurance: Covers damages caused by accidents or negligence, including bodily injury and property damage.

Finding the Right Insurance Provider

When selecting an insurance provider, it's essential to consider factors such as coverage options, premiums, deductibles, and claims process. At DealerPal, we have partnerships with reputable insurance companies that cater specifically to the needs of car dealerships. Our team can help you compare policies and find the best fit for your business.

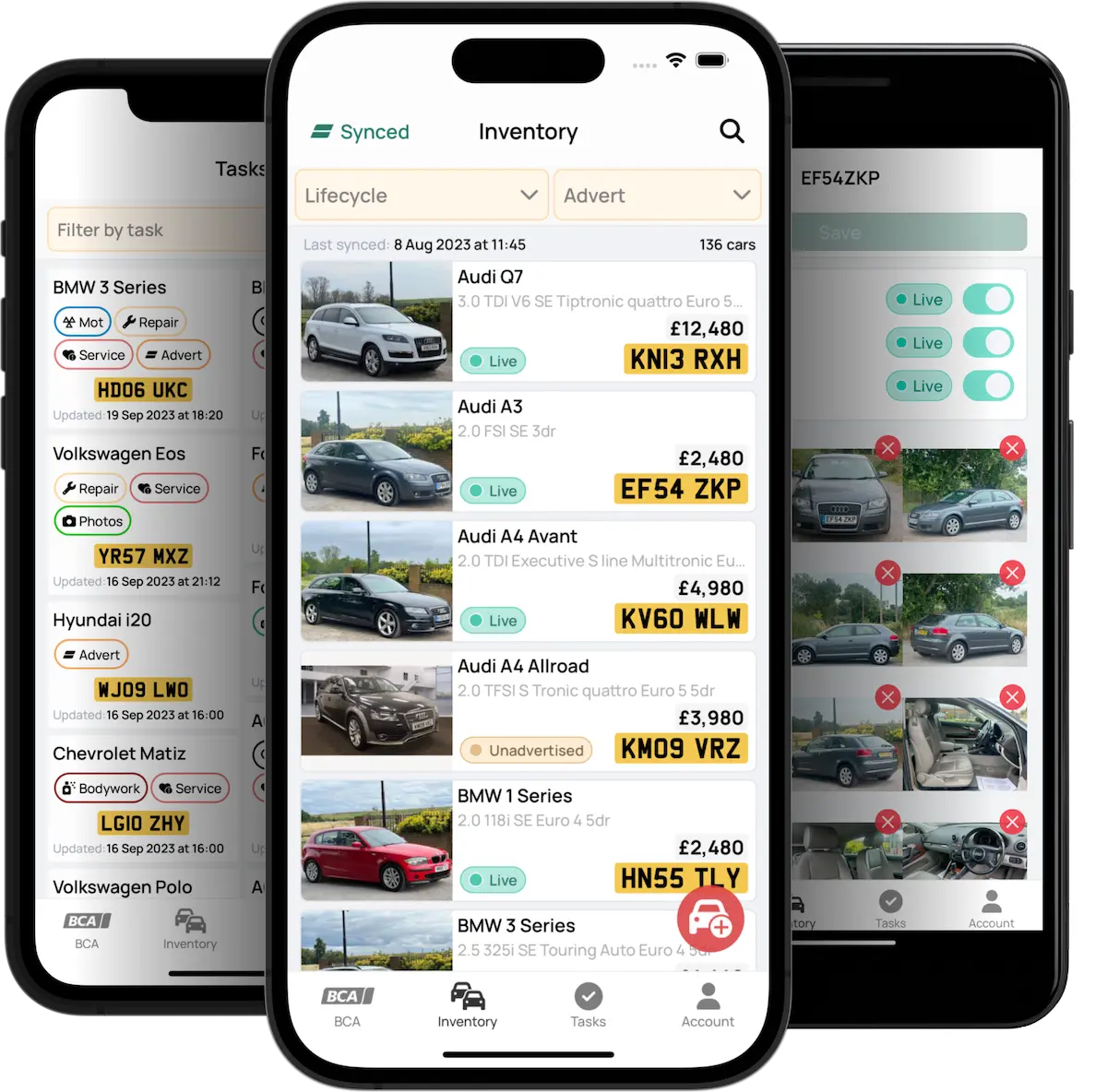

Save 10+ hours per week with our DMS

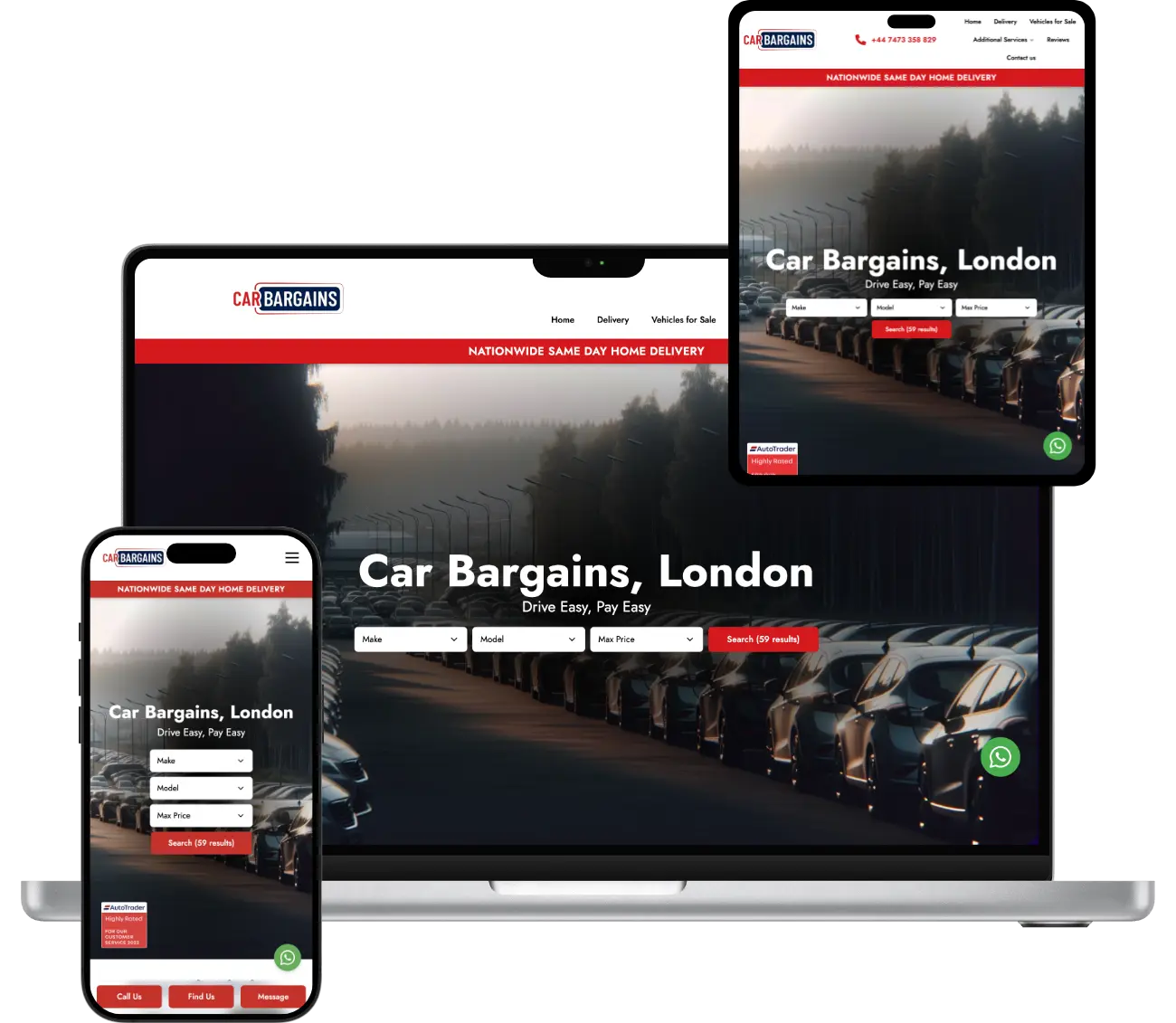

Sell more with our SEO-mastered retail websites

Branding that'll set you apart from the competition